Somali community desperate for Westpac money transfer reprieve

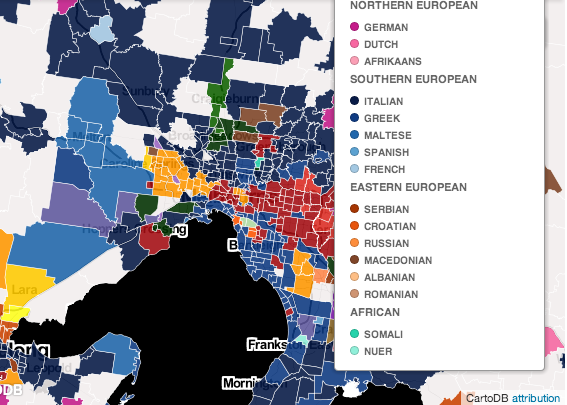

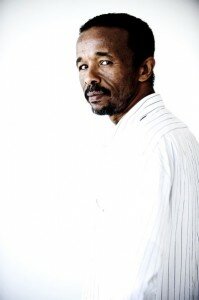

Somali Australian Council of Victoria president Hussein Haraco at a Bell St Mall money remittance agency. Picture: Andrew Henshaw.

Melbourne’s Somali community is warning innocent people will suffer if the last Australian bank to allow money transfers to the war-torn country follows through with its plan to stop the practice.

The community is desperate for a last minute reprieve after Westpac announced it was cutting links with money transfer agencies that send cash to the fragile country.

Westpac plans to follow other major banks and shut remittance accounts on November 24 over fears money will flow to terrorists or enable money laundering.

About 10,000 Somalis across the country will no longer be able to send money back to their families if Westpac becomes the last of the big four banks to shut down their accounts.

Somali Australian Council of Victoria president Hussein Haraco, also chair of the Somali Remittance Action Group, said the remittance agency account closures would stop a vital lifeline of money to households across Somalia.

Dr Haraco said Banyule — along with North Melbourne, Werribee and Broadmeadows — had a large Somali population and three remittance agencies at Heidelberg West’s Bell Street Mall.

He said Westpac was willing to discuss the issue but wanted the Federal Government to be involved.

“Shutting down these accounts may actually play into terrorist hands by sending the remittance industry underground where it cannot be policed,” Dr Haraco said.

Somali communities in Kensington and North Melbourne are fighting Westpac’s move, which they say is the last legal channel to get money to relatives living in dire poverty.

Kensington elder Abdurahman Jama Osman, who sends $100 every month to 85-year-old sister Halima, said he was deeply worried about her future.

“She will die (if I can’t send her money). She uses it to pay for food and for her rent,” Mr Osman said.

“She has no other income, no savings. She is not healthy.”

Mr Osman, who came to Australia as a refugee in 1998, said forcing money transfers underground would be risky for innocent people.

Abdurahman Jama Osman is concerned his elderly sister will die without his money transfers. Picture: Martin Reddy.

“Our people are very surprised by this. We are not terrorists, we don’t like what terrorists do. We are just trying to get money to needy people in Somalia,” he said.

Banyule Council has written to Prime Minister Tony Abbott, Federal Treasurer Joe Hockey, Jagajaga MP Jenny Macklin and Social Services MP Kevin Andrews asking for help in solving the issue.

Banyule spokeswoman Trish Hosking said the council had asked the Federal Government to intervene to keep existing banking accounts open for six months until a long-term solution could be found, as has happened in the US and UK.

Westpac spokesman Danny John said he could not comment on individual customer matters, but referred to an Australian Bankers’ Association statement about intensifying international and national regulations on remittances.

“(This resulted) in a decision by the bank to reduce its exposure to remitters,” Mr John said.

Association chief executive Steven Munchenberg said changing international regulations made providing payment services to remittance agencies increasingly difficult for the banking industry.

“The revised regulatory processes are part of an ongoing domestic and international process of verification of money transfers,” Mr Munchenberg said.

“This includes investing in the necessary internal and external safeguards to guarantee the nature of these payments.”

Dr Haraco said the community understood Somalia was considered a high risk country, but Somali money transfer operators followed Australian regulations and none had been deregistered by federal anti-money laundering and counter-terrorism financing regulator AUSTRAC.

He said 40 per cent of Somalian households were reported to depend on money transfers from relatives living in the developed world.

“The remittances are used for the purchase of staple foods like sorghum (flour substitute) and maize, sugar, and flour and tend to have a multiplier effect in local communities which helps households that don’t receive remittances themselves,” Dr Haraco said.

“Remittances are vital for Somalia’s fragile economy and its ability to feed and sustain itself.”

Source: Heidelberg Leader

Comments

comments

Calendar

Calendar

![Residents of Bulo Burde in Hiran region welcome African Union Mission in Somalia troops on March 14, 2014, a day after they forced al-Shabaab out of the town. [AU UN IST PHOTO / Ilyas A. Abukar]](/wp-content/uploads/2014/11/Bartamaha-300x200.jpg)

![A Benadir Electricity Company (BECO) technician works on the generators at one of the company's power stations in Mogadishu. [Warsame Afrah/Sabahi]](/wp-content/uploads/2014/11/beco-300x200.jpg)