‘Lifeline’ US-Somalia remittances on hold

Banks in the US state of Minnesota – home to a large ethnic Somali community – have stopped money transfer services to Somalia, fearful of prosecution under US anti-terror laws. But are ordinary people in the country wracked by drought and conflict paying the price?

Banks in the US state of Minnesota – home to a large ethnic Somali community – have stopped money transfer services to Somalia, fearful of prosecution under US anti-terror laws. But are ordinary people in the country wracked by drought and conflict paying the price?

“It’s really hard to go to work with a smile on your face because you know your family is struggling – they don’t have food on the table and you’re getting it,” says Zahra Hassan, one of Minnesota’s 32,000 Somali-Americans.

She lives in Minneapolis, which has the largest concentration of Somalis in the US, so much so that it is sometimes called “Little Mogadishu”.

Ms Hassan fled Somalia during the civil war in the early 1990s, was granted asylum and is now a US citizen, doing two jobs.

She has not had a holiday in the 10 years she has been in Minnesota, because she sends every spare cent she has to relatives back home.

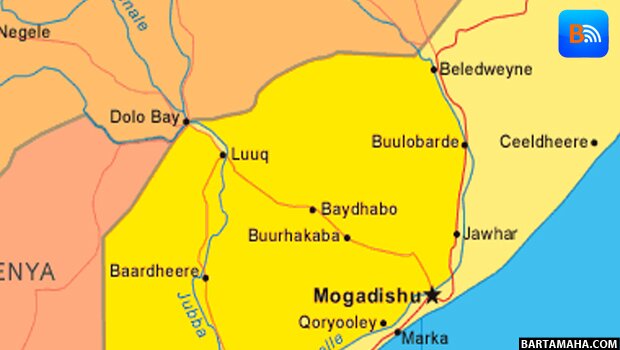

Conditions in Somalia are desperate – the country has been devastated by years of fighting, and is only just starting to emerge from a drought and a famine.

Her family is big, and her mother divides the money out to the most needy.

“I’m the only source of income for my family,” she says.

“The money I send basically covers shelter, food and education. When someone gets sick, that’s another cost.

“I feel it’s my responsibility to take care of my family, because the country is not taking care of them.”

Hitting home

One of those to benefit from her hard work is her 18-year-old nephew Abdullahi Hassan.

His family are nomads who live in the desert, but thanks to the money he gets from Ms Hassan, he has been studying at a school in Hargeisa – the capital of the self-declared republic of Somaliland, in north-western Somalia.

The conditions are modest. He lives in a small apartment – so small that he uses the kitchen as his bedroom.

Things were going well for him until just over a month ago when the last major bank in Minnesota to offer money transfers to Somalia shut down the service, fearful it could be prosecuted under US anti-terrorism laws.

US authorities are concerned that money sent to Somalia could end up in the hands of al-Shabab, an insurgent group with links to al-Qaeda which controls large parts of Somalia, and which is classed as a terrorist group by the US.

“I used to get $100 [£62] a month from my aunt,” says Mr Hassan.

“I had a reasonably good life, but now it’s really difficult for me because of the circumstances in America,” he explains.

“I cannot pay my rent, I cannot pay for food or for school fees. I was dependent on my aunt for everything – there is no other way for me to get money.

“Now I have nothing. It’s very difficult.”

Mr Hassan had planned to study science at university. Now he thinks he may have to return to live with his family as a nomad.

In the absence of an effective central government, Somalia depends heavily on remittances.

There are estimated to be around one million Somalis in the diaspora, and their contribution in the form of remittances makes up around one third of the country’s revenue.

Until now, around $100m per year was being sent in remittances from the US alone.

Terrorist threat

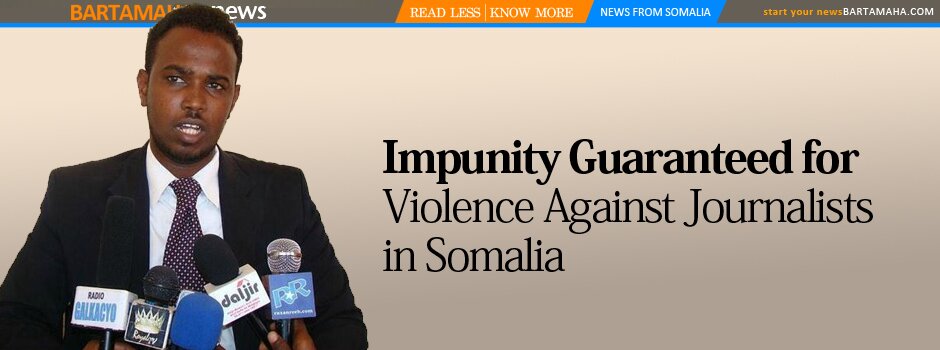

In October 2011, two women in Minnesota were found guilty of conspiracy to provide support to al-Shabab.

Evidence heard during the trial stated that they had sent $8,600 to the group via money transfers.

Though they deny there is any direct connection to this case, the last major bank in Minnesota offering services to Somalia stopped doing so soon after, deeming the risk too great.

Federal authorities are not only concerned about money being purposely funnelled to al-Shabab, but also the group’s ability to intercept funds once they arrive in Somalia.

“The likelihood of it ending up in the hands of al-Shabab or another terrorist organisation is a distinct possibility, regardless of who is identified as the end recipient,” says Supervisory Special Agent EK Wilson of the FBI field office in Minnesota.

There are no formal banks in Somalia, so the money transfers come in via the hawala system – a traditional Islamic form of banking which relies heavily on trust, and it is argued, is therefore more open to abuse.

But there is a recognition within the intelligence community that the bulk of funds sent by Somalis in the US to their country of birth is aimed at improving the lot of residents there.

“The vast majority of that money is for legitimate, lawful purposes,” says Mr Wilson.

“There are many hard-working Somalis here in Minneapolis who are just trying to live the American dream and provide for their families.

“[But] the very small fraction of a percentage of that money that is destined for al-Shabab could prove significant.”

Lifeline cut

Ms Hassan used to send her money home via Dahabshiil, one of the largest money transfer companies in the world, which has its operation centre in Hargeisa.

It operates according to international banking rules – it is too big not to, moving millions of dollars worth of remittances every month.

In his marble-clad banking hall, Dahabshiil chief executive Abdulrashid Duale demonstrates the computer systems that, he says, guarantee the transparency of the money flows he manages.

Take a look inside one of the largest money transfer companies in the world

“Anyone who comes here to collect money has to show ID – two forms. And they only come to collect the money because we have texted them – that’s another check, because we have their phone number.”

Records of the transactions are stored and those records are available to banking regulators, he says.

Mr Duale wants banks in the US to reconsider the shut down, especially given the desperate humanitarian situation in Somalia.

“There is a drought, there is a famine… We are still negotiating with the banks, and I hope there will be a way to get through this because this is a lifeline.”

Some small sums are still getting through he says, like $20 or $50.

But it is not a sustainable situation and – he argues – the clampdown on money transfers will ultimately lead to less transparency, not more.

“In one way or another Somalis will get money back to here. But it’s going underground and black-market.

With the big drop in money getting through from the diaspora in the US, this could – it is argued – foster frustration and resentment.

“We are going to create more people against the United States,” believes Ms Hassan.

“These kids, when they don’t have education, when they don’t have food, what are they going to do?

“Al-Shabab may ask them to do jobs for them – are they going to say, no?”

Her nephew chips in: “I’m not really resentful, I’m not angry at the Americans.

“But life is very difficult. I don’t know what I am going to do.”

__

BBC

Comments

comments

Calendar

Calendar