Forget piracy, Somalia’s whole ‘global’ economy is booming – to Kenya’s benefit

The collapse of the Somali state in 1991 gave rise to the shopping mall phenomenon in Nairobi’s Eastleigh area.

It began sometime in 1994, when refugees staying at Garissa Lodge, the once undistinguished lodging located near the corner of Wood Street and Eastleigh 1st Avenue, began using their rooms as daytime shops.

The two-storied building quickly became the business model for the neighbourhood’s rapidly expanding retail bazaar.

By 1998 there were at least eight other converted-building malls; a second generation of shiny new commercial buildings began sprouting up soon afterwards.

The business model spread to other towns and reproduced itself in neighbouring countries.

Garissa Lodge remains the spatial hub of the expanding commercial juggernaut dominated by Somalis of the diaspora.

The flow of capital into Kenya continues and Somalis have been purchasing urban property in Nairobi and Mombasa at a rate raising alarm in many quarters.

In Mombasa, for example, resentment among the town’s Swahili and Asian Muslims is rising. The spread of open-air stalls centred at Mackinnon market clogged the narrow lanes of Old Town then crossed Kenyatta Avenue.

Somalis have now bought out virtually all the local wholesale and retail shops in Bondeni. Somalis in search of prime urban businesses and property are willing to pay prices that make resistance futile.

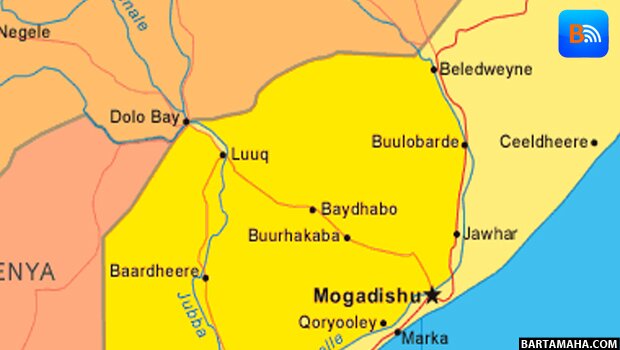

The last time I was in Mombasa, friends pointed out a 2.5 acre property between Mwembe Kuku and Kilifi, valued at approximately Ksh30 million ($400,000) before the latest boom, that was recently sold for Ksh215 million ($2.86 million).

Similar reports abound in Nairobi. While the premiums paid rarely approach the 7x multiple of “natural†value in the case above, the phenomenal scale of Somali investment in Kenyan real estate is beginning to transcend conventional economic rationality.

Where does this capital come from? Many Kenyan observers claim the ransoms paid to Somali pirates account for the lion’s share of the cash inflating urban real estate values.

The Somali may be the world’s thickest-skinned entrepreneurs, but neither this trait nor the successes of Somali pirates over the past several years sufficiently explain the mystery of Somali capital.

Knowledge of the pirate business and how its profits are distributed make the pirate hypothesis easy enough to debunk.

Suppliers providing for the pirates’ supplies and the maintenance of the captured crew during the period between capture and ransom are reimbursed off the top.

Local elders and other politicians receive up to 10 per cent of the ransom. Investors involved in the management of maritime intelligence, negotiations, and transfers, in addition to covering fixed costs (vessels and equipment), receive a 30 per cent share. Another 30 per cent is divided among the crew.

Naval patrols have raised the operational costs by forcing crews to increase the distances covered and the time spent at sea. There are hidden social costs.

Regardless, analysis of the pirate economy indicates a minority share of the profits is available for outside investment — at the most $40 million of the approximately $100 million in ransoms paid over the past two years.

There are more robust income streams feeding the river of Somali capital.

Kenyan Somalis have distinguished themselves in high-income professions and the private sector. Somali transporters and traders operate across a region spanning the Congo, Southern Sudan, the Horn, and Southern Africa.

Many thousands of Somalis are employed and running businesses in the diaspora. Only the Iranians export more goods from Dubai.

Much of the monies provided by Western and Islamist financiers for weapons and military operations are diverted into more productive activities.

The failure of clan politics in the homeland highlights the reinvigorated socio-economic role of Somali segmentary lineages.

Traditional social organisation allows Somalis in Africa and abroad to pool their financial resources. These contemporary factors and traditional pastoralist resilience, mobility, and risk-taking — not pirates and banditry — go a long way towards explaining the dynamics of Somali capitalism.

Much of the capital is finding its way into Kenya — which has over time evolved a more adaptive and mutually beneficial strategy for domesticating the threat of Somali irredentism.

Ethiopia, in contrast, persists in pursuing a militaristic solution in the Ogaden region and beyond.

If Ethiopia has little to bank for its troubles, what about developments in Eastleigh, where Somali and Ethiopian peacefully co-exist?

Economic activity appears more feverish with each passing month, but Eastleigh’s shopping malls are a monoculture of stalls and small shops selling the same clothes, electronics, household goods, cosmetics, and groceries.

While the regional wholesale trade helps boost the bottom line, commerce alone cannot account for the Garissa Lodge model’s vigour.

The multiple streams of networked capital behind these self-same storefronts are also driving the inflation in the real estate sector. In both cases, the economic rationale appears to be more about establishing an economic stake close to home than shareholder dividends.

Increasing numbers of empty shops are among the signs suggesting the real estate bubble is bound to burst. If and when it does, the sellers who reaped the windfalls will celebrate — and there will be no weeping and gnashing of Somali teeth.

Unlike Wall Street, the Somalis pay in cash. Unlike sub-prime mortgages amalgamated into bonds, their investment in property will not evaporate.

It’s a long-term strategy. Kenya’s urban economy will forge ahead. Like the warlords, the pirates will fade away. The capital generated by the ethno-economic networks may yet prove to be Somalia’s saving grace.

Flashad

———-

Source:- .theeastafrican.co.ke

Comments

comments

Calendar

Calendar